Discover Treasury Cashflow API Solutions with Fennech's Connectivity Tools

Having a clear view of your company's cash flow is crucial. That's where treasury cashflow API solutions come in. These tools help you manage and monitor your cash flow more effectively by connecting various financial systems and data sources.

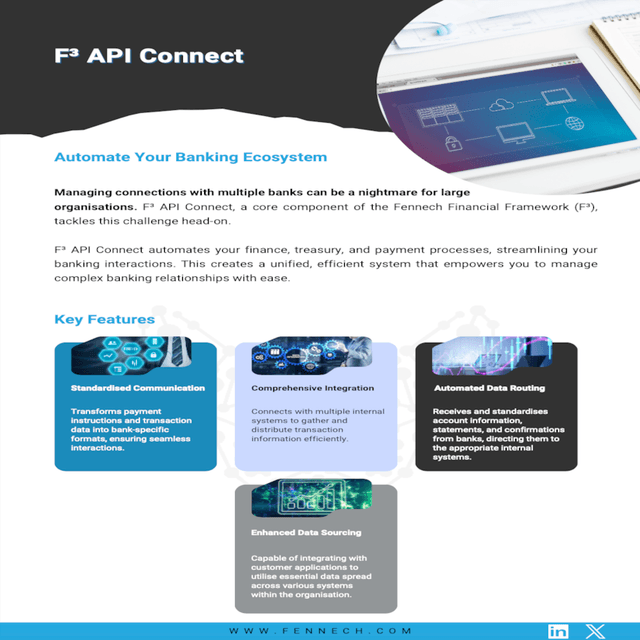

Fennech offers a standout solution in this space. Their API solution, API Connect, makes it easier for businesses to link up their treasury systems. This means smoother operations and quicker access to important financial information.

How Does Fennech's API Connect Help

-

Simplifies Connectivity: API Connect ensures that all your financial systems talk to each other seamlessly. No more manual data entry or juggling multiple platforms.

-

Streamlines Workflows: By connecting your treasury systems, API Connect helps you cut down on repetitive tasks. This saves time and reduces the risk of errors.

-

Optimises Treasury Management: With all your financial data in one place, managing your cash flow becomes much more straightforward. You can make better, faster decisions with a complete view of your finances.

For SME and enterprise finance leaders looking to improve their treasury operations, Fennechs API Connect is a game-changer. It brings efficiency and clarity, allowing you to focus on what matters, growing your business.

Download our comprehensive guide to dive deeper into how Fennech's API Connect can transform your treasury workflows. It's packed with insights to help you get the most out of your cash flow management.