Fennech’s Solutions for Treasury Teams in 2025

The treasury landscape is evolving at an unprecedented pace, and businesses must adapt to meet the demands of a dynamic financial environment. By 2025, the need for streamlined, automated and highly integrated treasury processes will be more crucial than ever. Fennech Financial stands at the forefront of this transformation, offering innovative solutions tailored to empower treasury teams with efficiency, accuracy and real-time insights.

The Challenges Facing Treasury Teams

Treasury teams often juggle multiple responsibilities, from managing cash flow and liquidity to ensuring regulatory compliance and mitigating financial risks. In 2025, these challenges are expected to grow, driven by:

• Increased Complexity: Globalisation and digital transformation have introduced complex financial structures, cross-border transactions, and diverse regulatory requirements. • Demand for Real-Time Data: Businesses need instant access to financial data to make informed decisions in volatile markets. • Pressure to Reduce Costs: Companies are under constant pressure to optimise processes while cutting costs. • Cybersecurity Risks: As treasury functions become increasingly digital, the need for robust security measures will intensify.

How Fennech Supports Treasury Teams

Fennech Financial provides a suite of advanced tools and technologies designed to address these challenges head-on. Here’s how Fennech is reshaping treasury management in 2025 and beyond:

-

Hyper-Automation for Maximum Efficiency Fennech’s platform leverages hyper-automation to streamline treasury processes, eliminating manual tasks and reducing errors. Whether it’s reconciling payments, managing liquidity, or forecasting cash flow, Fennech automates complex workflows to save time and resources.

-

Real-Time Insights with Advanced Analytics Treasury teams need actionable insights to make data-driven decisions. Fennech’s solutions provide real-time analytics, offering a clear view of cash positions, transaction trends, and financial risks. These insights enable teams to optimise their strategies and respond quickly to market changes.

-

Seamless Integration with Existing Systems Fennech’s platform is designed to integrate effortlessly with existing ERP systems, banks, and other financial tools. This ensures that treasury teams can access all their financial data from a single, unified platform, enhancing efficiency and transparency.

-

Enhanced Security and Compliance In an era of increasing cyber threats and stringent regulations, Fennech prioritises security and compliance. The platform includes built-in safeguards such as multi-factor authentication, data encryption, and automated compliance checks to protect sensitive financial information.

-

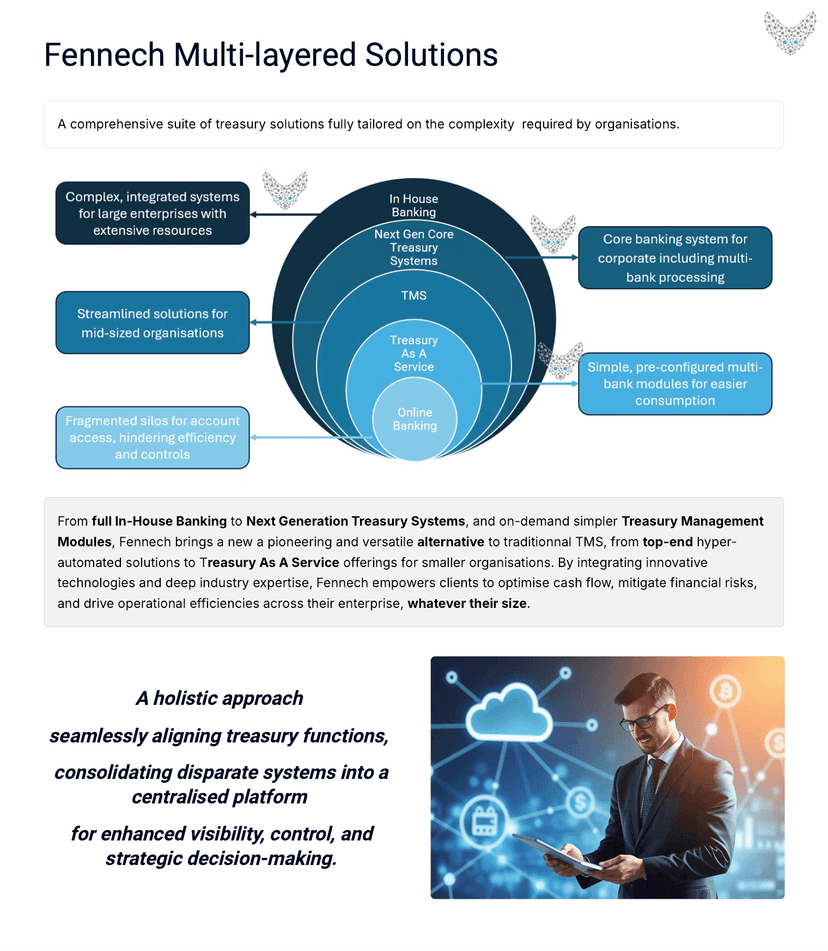

Scalable Solutions for Growing Businesses Fennech’s modular design allows businesses to scale their treasury solutions as they grow. From small enterprises to multinational corporations, Fennech provides the flexibility to adapt to evolving needs without disrupting operations.

Why Choose Fennech in 2025?

Fennech Financial is more than just a treasury management solution; it’s a strategic partner for businesses looking to thrive in a fast-paced financial world. By choosing Fennech, treasury teams gain access to:

• Customisable Solutions: Tailored to meet the unique needs of every organisation. • Cutting-Edge Technology: Empowering teams with the latest in fintech innovation. • Expert Support: A dedicated team of professionals to ensure seamless implementation and ongoing optimisation.

Get Started with Fennech Today

As treasury teams prepare for the challenges of 2025, partnering with Fennech is a step towards greater efficiency, transparency, and control. Discover how Fennech can transform your treasury operations and set your business up for success.