Managing treasury invoices can be a complex task, but Fennech is here to simplify it for you. Whether you are an SME or an enterprise finance leader, our versatile Treasury Management Solutions cater to all your needs.

Treasury Management Solutions For All

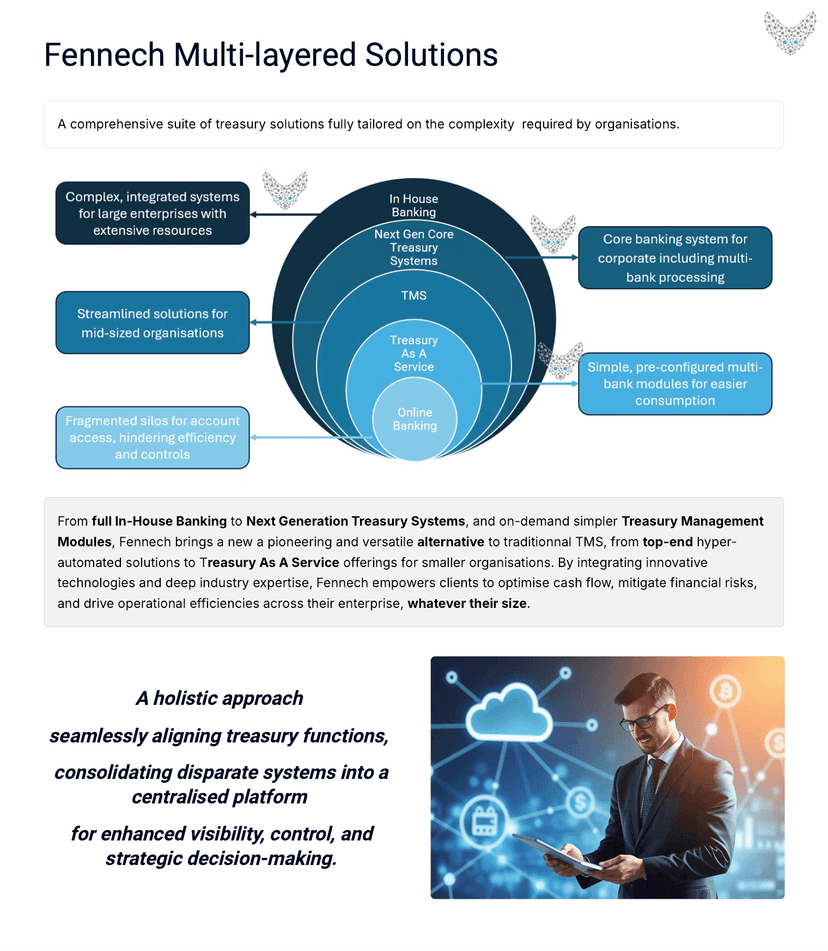

From full InHouse Banking to Next Generation Treasury Systems, Fennech offers a pioneering alternative to traditional Treasury Management Systems TMS. Our solutions range from hyper-automated top-end systems to simpler, ondemand Treasury Management Modules. This flexibility means you can choose a solution that perfectly fits your organisation, whether you are a large enterprise or a smaller business looking for efficient, manageable treasury operations.

Elevate Your Corporate Treasury Management with the Automated Liquidity Management Solution

Are you looking to enhance your organisations liquidity management Introducing Fennechs F Platform, a game changer in Automated Liquidity Management! Here are some key advantages:

Ease of Administration: Simplify your treasury tasks with user-friendly interfaces and automated processes. Bank Independent: Manage your liquidity without being tied to a specific bank, giving you more freedom and flexibility. Tailored Sweeping Rules: Customise your cash sweeping rules to fit your specific needs and optimise cash flow. Intercompany Loan Tracking: Keep track of internal loans easily, ensuring transparency and efficiency. Cloud-Based & Standard Format Ready: Access your data anytime, anywhere with our secure cloud-based solution that supports standard formats. Competitive Pricing: Get top tier features without breaking the bank.

With Fennech's F Platform, redefine the way you manage liquidity effortlessly, flexibly, and intelligently.

Streamline Cash Flow for Your Network

F Agency Management from Fennech Financial Framework F is a revolutionary solution that simplifies cash flow for your organisation. Leveraging advanced digitalisation and automation, F streamlines payables and receivables, ensuring accurate allocations and distributions. This significantly reduces manual workload and frees up working capital, empowering your organisation to focus on what matters most.

Whether you need full inhouse banking capabilities or a more straightforward treasury management module, Fennech provides a robust and adaptable solution. Our innovative technology ensures you stay ahead of the curve, managing your treasury operations with ease and precision.

Choose Fennech to elevate your treasury management, streamline your cash flow, and free up resources to focus on growing your business.