Let's dive into how Fennech uses various payment types like FPS and BACS to help its clients, focusing on SME and enterprise finance leaders.

Treasury Management Solutions for All

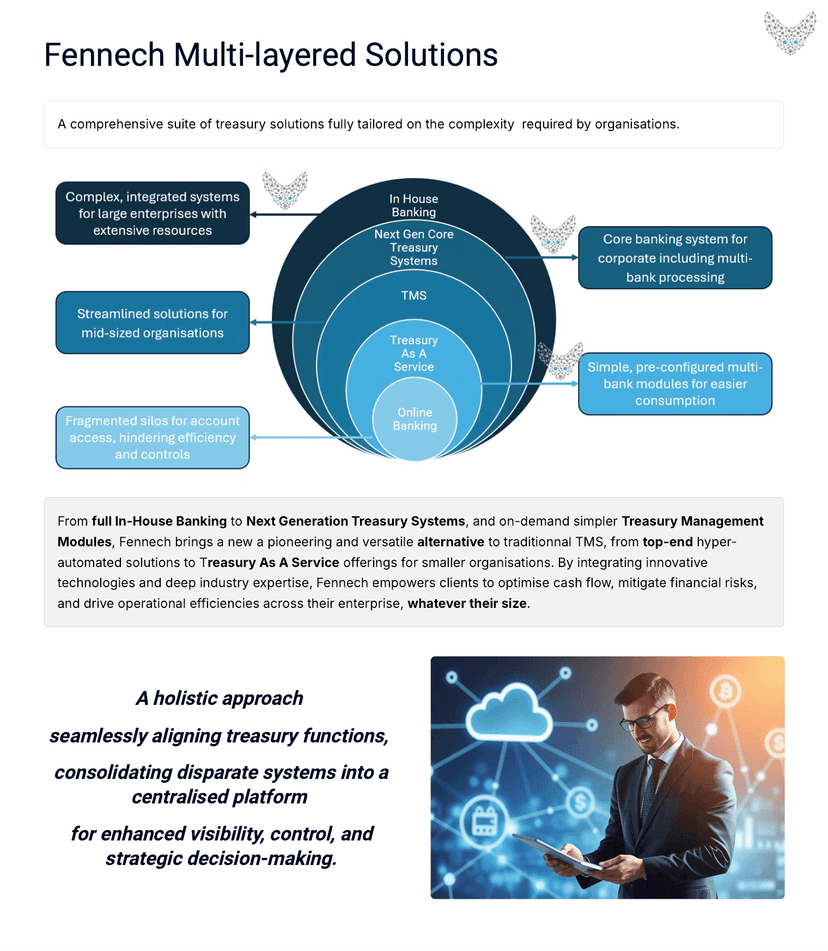

Fennech offers a wide range of treasury management solutions suitable for any organisation, whether you're a small SME or a large enterprise. From full in-house banking to next-generation treasury systems, Fennech provides pioneering alternatives to traditional Treasury Management Systems (TMS). For larger organisations, our hyper-automated solutions can handle complex treasury operations seamlessly. For smaller businesses, our Treasury as a Service offering delivers on-demand, simpler treasury management modules.

By using different payment types like FPS and BACS, Fennech ensures that your financial operations are smooth and efficient. FPS enable near-instantaneous fund transfers, ideal for urgent transactions. BACS payments, known for their reliability and cost-effectiveness, are perfect for routine payroll and supplier payments.

Streamline Cash Flow for Your Network

Fennechs F³ Agency Management, part of the Fennech Financial Framework F³, is a revolutionary solution designed to simplify cash flow for your organisation. Using advanced digitalisation and automation, F³ streamlines both payables and receivables. This ensures accurate allocations and distributions, significantly reducing manual workload and freeing up working capital.

For example, Faster Payments can be used to quickly settle invoices, improving cash flow and reducing the risk of late payment penalties. BACS can handle bulk payments like payroll, ensuring employees are paid on time with minimal effort.

From Chaos to Calm: 5 Problems Solved by Payment Automation

If you're tired of juggling invoices, chasing approvals, and worrying about payment errors, you're not alone. Payment automation can be the silver bullet for your most pressing financial challenges. With Fennechs Financial Framework F³, you can say goodbye to manual headaches and hello to streamlined efficiency.

-

Invoice Processing: FPS can speed up the settlement of invoices, eliminating the need to chase payments.

-

Approval Workflows: Automated systems reduce the need for manual approvals, minimising delays and errors.

-

Payment Errors: BACS payments are reliable and reduce the chances of payment errors, ensuring smooth transactions.

-

Cash Flow Management: Faster and more reliant payments help provide quicker access to funds and improve liquidity.

-

Resource Allocation: Automation frees up your finance team to focus on strategic tasks rather than mundane, repetitive work.

By integrating these payment types into Fennechs solutions, your organisation can benefit from a more efficient, reliable, and streamlined financial management system. This not only improves cash flow but also allows you to focus on what truly matters, growing your business.