Transform Your Financial Operations: Fennech's Auto Payment Solutions

Are you tired of juggling invoices, chasing approvals, and worrying about payment errors? You're not alone! Fennech's advanced Auto-payment solutions are designed to simplify transactions, making life easier for SME and enterprise finance leaders. Our approach to solving your payment issues ensures clarity and effectiveness, no matter the size of your organisation.

From Chaos to Calm: 5 Problems Solved by Payment Automation

Imagine a world where you no longer have to deal with the chaos of manual payments. With Fennechs Financial Framework, F³, this can be your reality. Payment automation addresses your most pressing financial challenges, transforming chaos into calm. Here are five common problems that are solved with our solution:

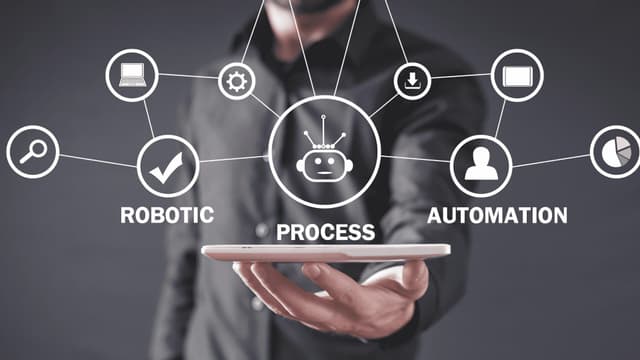

- Manual Errors: Eliminate the risk of human error in payment processing.

- Time-consuming Approvals: Speed up approval workflows and reduce bottlenecks.

- Invoice Management: Simplify invoice tracking and ensure timely payments.

- Cash Flow Issues: Improve cash flow management with automated scheduling.

- Resource Allocation: Free up your team to focus on strategic tasks rather than manual work.

By adopting F³, you say goodbye to manual headaches and hello to streamlined efficiency.

If you're curious about how Fennech can transform your financial operations, download our comprehensive guide to learn more about our advanced Auto-Payment solutions. Discover how we can help you simplify transactions, improve efficiency, and empower your organisation to thrive.