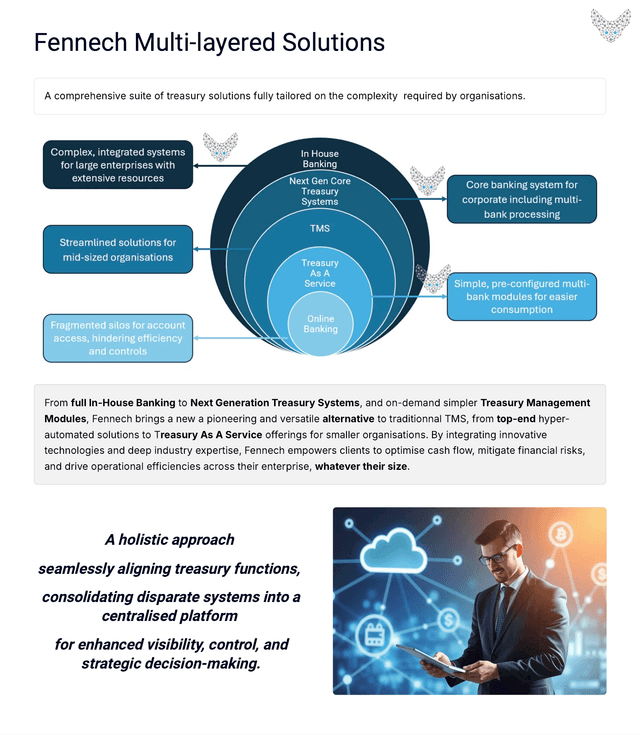

Treasury Solutions and Management in the Digital Era

In today's digital world, treasury management has evolved significantly. For SMEs and large enterprises alike, adapting to new technologies and strategies is essential for staying competitive. This guide will explore key treasury management strategies tailored for the digital era, with a focus on innovation and efficiency.

- Embrace Digital Tools

One of the most significant changes in treasury management is the shift towards digital tools. These tools help streamline processes and improve accuracy. For example, cloud-based treasury management systems (TMS) offer real-time data access, allowing finance leaders to make informed decisions quickly. Additionally, automation software can handle repetitive tasks, reducing the risk of human error and freeing up time for more strategic activities.

- Enhance Cash Flow Forecasting

Accurate cash flow forecasting is crucial for any business. In the digital era, advanced analytics and AI can provide more precise predictions. By analysing historical data and market trends, AI can help predict future cash flows more accurately. This allows businesses to plan better, avoid cash shortages, and make the most of surplus funds.

- Improve Risk Management

Digital technologies also play a vital role in risk management. With real-time data and advanced analytics, businesses can identify potential risks earlier and take proactive measures. For example, digital platforms can monitor market fluctuations and alert treasury managers to potential threats, such as currency volatility or interest rate changes. This enables businesses to act swiftly and minimise financial risks.

- Streamline Payments and Collections

Efficient payment and collection processes are essential for maintaining healthy cash flow. Digital payment solutions, such as electronic funds transfer (EFT) and mobile payment apps, offer faster and more secure transactions. These methods reduce processing times and lower the risk of fraud. Additionally, digital invoicing and automated reminders can help ensure timely collections, improving overall cash flow.

- Foster Innovation

Innovation is at the heart of digital treasury management. Encouraging a culture of innovation within the finance team can lead to the discovery of new solutions and improvements. For example, exploring blockchain technology for secure and transparent transactions or using machine learning to optimise investment strategies can provide a competitive edge.

- Prioritise Cybersecurity

As businesses become more reliant on digital tools, cybersecurity becomes increasingly important. Ensuring that all digital platforms and tools are secure is vital to protect sensitive financial data. Regularly updating systems, using strong encryption, and educating staff about cybersecurity best practices can help safeguard the business against cyber threats.

In the digital era, treasury management is all about leveraging technology to drive innovation and efficiency. By embracing digital tools, improving cash flow forecasting, enhancing risk management, streamlining payments and collections, fostering innovation, and prioritising cybersecurity, finance leaders can ensure their treasury operations are robust and futureproof. For SMEs and large enterprises alike, these strategies provide a roadmap to success in the ever evolving digital landscape.