Open Banking and How Fennech Helps Businesses

Open banking is revolutionising the financial landscape by enabling secure data sharing between banks, businesses, and third-party providers. By leveraging APIs (Application Programming Interfaces), open banking empowers businesses with real-time financial insights, streamlined processes, and improved customer experiences. Fennech Financial plays a pivotal role in helping businesses harness the potential of open banking, delivering tailored solutions that enhance operational efficiency and drive growth.

What is Open Banking?

Open banking is a system that allows businesses to access financial data securely and efficiently from multiple sources. Key benefits include:

Data Transparency: Provides a unified view of financial information from various accounts and institutions. Improved Decision-Making: Enables better cash flow management and forecasting through real-time data access. Enhanced Customer Experience: Facilitates personalised financial services and faster transactions.

Challenges Businesses Face with Open Banking

While open banking offers numerous benefits, businesses often encounter challenges, including:

Integration Complexities: Connecting disparate systems and platforms can be time-consuming and resource-intensive. Data Security: Ensuring the safety of sensitive financial data is critical in an open banking ecosystem. Regulatory Compliance: Meeting strict standards like GDPR and PSD2 requires robust systems and expertise.

How Fennech Supports Businesses with Open Banking

Fennech Financial’s F³ platform is designed to address these challenges, enabling businesses to unlock the full potential of open banking. Here’s how Fennech helps:

-

Seamless API Integration Fennech simplifies the integration process, connecting businesses to multiple financial institutions through a unified platform. This ensures a seamless flow of data and eliminates the need for manual data entry.

-

Real-Time Financial Insights With F³, businesses gain real-time access to their financial data, empowering them to make informed decisions about cash flow, liquidity, and payments. This level of visibility is crucial for maintaining a competitive edge.

-

Advanced Security Measures Fennech prioritises data security, employing encryption, tokenisation, and robust access controls to protect sensitive financial information. This ensures compliance with regulatory standards while safeguarding business data.

-

Automation for Efficiency F³ automates routine financial processes like reconciliations, payments, and reporting, freeing up resources for strategic activities and reducing operational costs.

-

Customised Solutions Fennech works closely with businesses to tailor open banking solutions that align with their unique operational needs and goals. This personalised approach ensures maximum value and usability.

The Benefits of Fennech’s Open Banking Solutions

Businesses leveraging Fennech’s open banking capabilities experience significant advantages:

Enhanced Efficiency: Automating data sharing and workflows saves time and reduces errors. Improved Decision-Making: Real-time data enables accurate forecasting and strategic planning. Scalability: F³’s modular design grows with your business, adapting to evolving needs. Cost Savings: Streamlined processes lower operational costs and improve ROI.

Why Choose Fennech for Open Banking?

Fennech Financial’s expertise in open banking, combined with its innovative technology, makes it the ideal partner for businesses looking to optimise their financial operations. With F³, you gain:

Seamless Integration: A platform that connects with banks and third-party services effortlessly. Real-Time Insights: Actionable data for smarter financial decisions. Secure Operations: Advanced measures to protect sensitive information. Customised Support: Solutions tailored to your specific needs.

Unlock the Power of Open Banking with Fennech

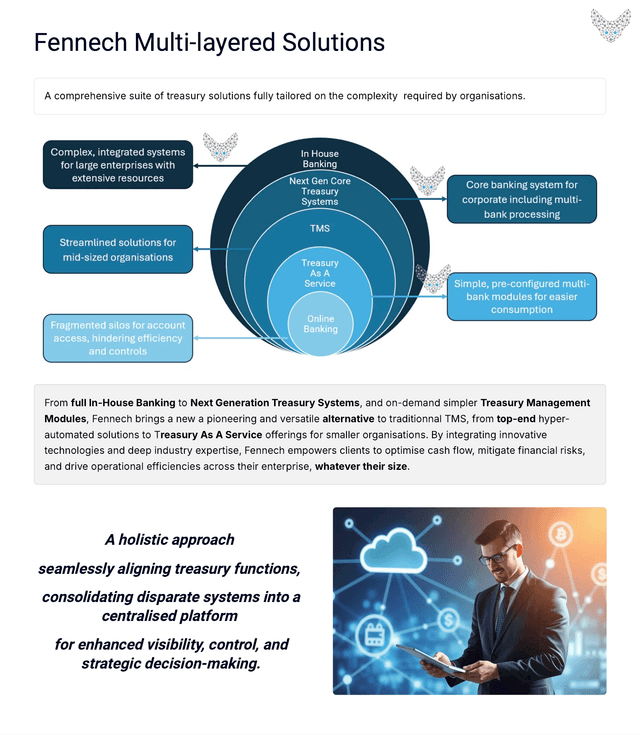

Open banking is the future of financial management, and Fennech Financial ensures businesses are ready to thrive in this new era. By simplifying integration, enhancing security, and delivering real-time insights, Fennech helps businesses harness the full potential of open banking.