Navigating ERP Integration Challenges with Treasury Management Systems

In the world of finance, especially for small to medium enterprises SMEs and larger corporations, the integration of Enterprise Resource Planning ERP systems with Treasury Management Systems TMS can often feel like steering a ship through a storm. While the promise of hyperautomation and streamlined processes is enticing, the challenges that come with such integration can be daunting. Lets unpack some of those challenges and explore how modern solutions, like F and APIdriven integrations, can help finance leaders navigate these waters.

The Challenges of Leveraging HyperAutomation

For many organizations, the goal of hyperautomation in payments and treasury processes is a top priority. However, the fragmented nature of banking systems, ERPs, and TMS often leads to operational hurdles that can stall these initiatives. Imagine trying to put together a puzzle where the pieces dont quite fit together. Thats the reality many finance teams face when their systems operate in silos.

These silos lead to disjointed workflows, where information is trapped within individual systems. Finance teams often find themselves duplicating data entry across platforms, which not only wastes time but also increases the potential for errors. Furthermore, the lack of realtime visibility into cash flows and financial positions makes it challenging to make informed decisions quickly. The cost of complexity in integration can be high, both in terms of time and resources, leaving finance leaders feeling overwhelmed.

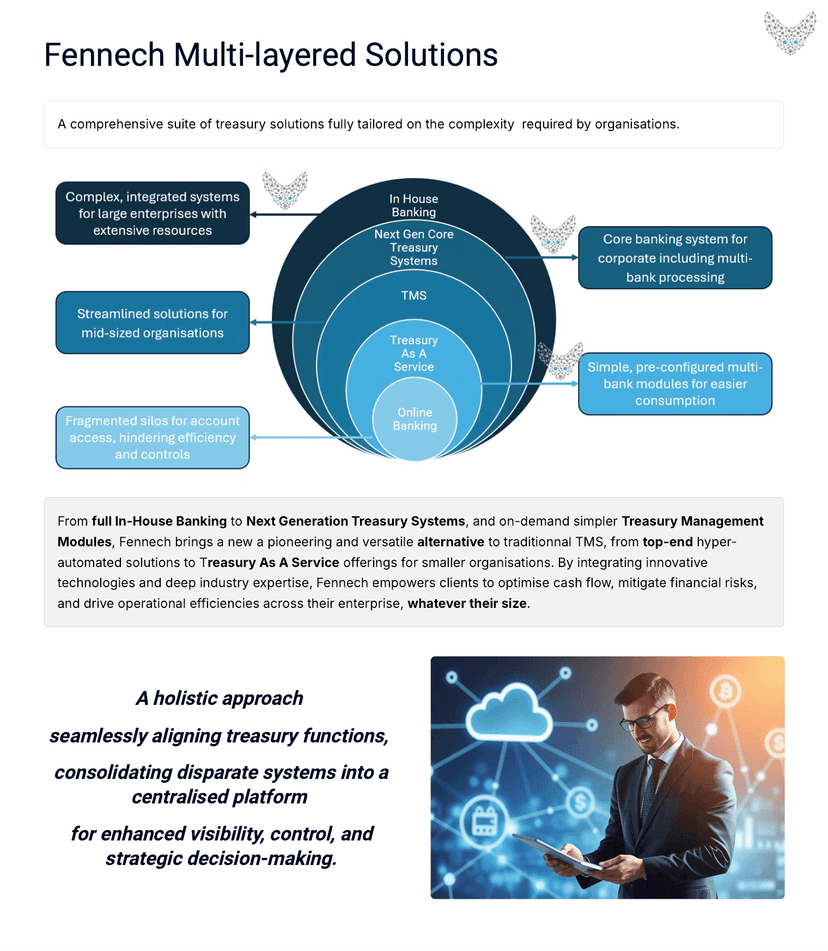

A Platform at the Crossroads of ERP, Core Banking, and TMS

Enter F, a cloudbased platform designed to bridge the gaps between ERP, core banking, and TMS. Imagine having a powerful tool that combines the best features of these systems into one seamless solution. F not only alleviates the pain points associated with fragmented systems but also offers a robust, scalable, and customizable approach to managing payments, cash, risk, and financing.

With F, finance leaders can finally breathe a sigh of relief. The platform provides an integrated view of financial operations, enabling organizations to manage their treasury functions more efficiently. By centralizing data and processes, F helps eliminate redundancy, reduces manual entry, and enhances overall operational efficiency. This means less time spent on tedious tasks and more time dedicated to strategic decisionmaking.

Discover the Transformative Potential of APIDriven Treasury Integration

In todays fastpaced financial landscape, the need for realtime data access is more critical than ever. This is where APIdriven treasury integration comes into play. Think of APIs as the bridges that connect disparate systems, allowing for instantaneous data flow between your ERP and TMS.

This integration is not merely a modern convenience its a strategic catalyst for growth and efficiency. With realtime visibility into cash positions and transaction statuses, finance leaders can make informed decisions swiftly. This means being able to respond to market changes, optimize cash flows, and ensure compliance with regulatory requirements effortlessly.

Moreover, APIdriven integration simplifies operations by reducing the manual tasks associated with transferring information between systems. Finance teams can focus on highervalue activities, such as analyzing trends and forecasting, rather than getting bogged down in administrative tasks.

Conclusion

For finance leaders in SMEs and enterprises alike, the challenges of ERP integration with TMS are significant but not insurmountable. By embracing solutions like F and leveraging APIdriven integration, organizations can transform their treasury functions from a collection of disjointed processes into a streamlined, cohesive operation.

The journey towards hyperautomation may be fraught with challenges, but with the right tools and strategies, finance leaders can navigate these waters successfully, leading their organizations to greater efficiency, compliance, and ultimately, success.