Understanding the New ISO Messaging Standard: A Guide for SME and Enterprise Finance Leaders

The financial world is constantly evolving, and staying updated with the latest standards is crucial. One such significant development is the ISO messaging standard. But what exactly is ISO, and why is it important for financial messaging? Let's delve into this and see how Fennech supports this standard, offering a range of treasury solutions tailored for both SMEs and enterprises.

What is ISO?

ISO stands for the International Organization for Standardization. It develops and publishes international standards, ensuring quality, safety, efficiency, and interoperability. In the financial sector, ISO standards ensure that financial messages are consistent, clear, and secure across different systems and institutions.

The New ISO Messaging Standard

The new ISO messaging standard, often referred to as ISO 20022, is designed to improve the quality and transparency of financial messaging. It covers a wide range of financial services, including payments, securities, trade services, and forex. This standard introduces a more structured and data-rich format, enabling better communication and processing of financial transactions.

The Significance for Financial Messaging

The adoption of ISO 20022 brings numerous benefits:

-

Enhanced Data Quality: With a structured format, financial messages include more detailed and accurate information, reducing errors and discrepancies.

-

Improved Interoperability: ISO 20022 promotes seamless communication between different financial institutions and systems, regardless of their location or technology.

-

Increased Efficiency: The new standard streamlines processes, leading to faster and more efficient transaction processing.

-

Better Compliance: It helps organisations meet regulatory requirements by providing a clear and consistent data framework.

Fennech's Support for ISO Standards

At Fennech, we understand the importance of adopting the latest standards to stay competitive and compliant. Our treasury solutions are designed to support the ISO messaging standard, offering a range of options to suit different organisational needs.

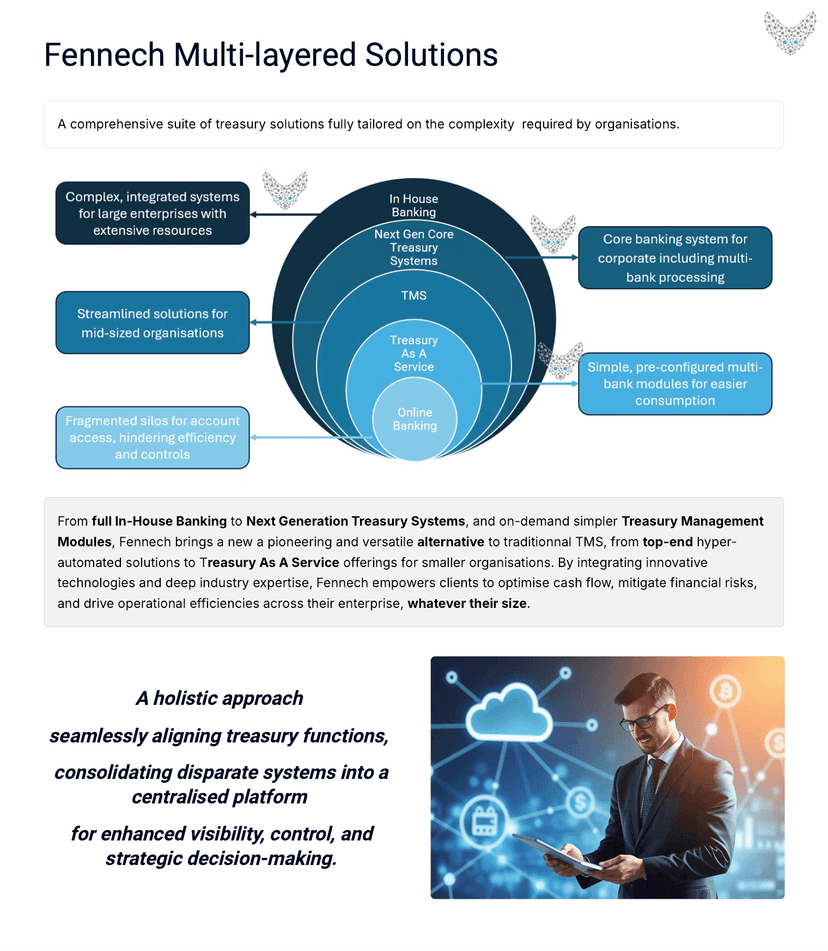

Treasury Management Solutions for All

Whether you need full in-house banking, next-generation treasury systems, or simpler on-demand treasury management modules, Fennech provides a pioneering and versatile alternative to traditional TMS. Our solutions range from top-end hyper-automated systems to Treasury as a Service offerings for smaller organisations. This flexibility ensures that both SMEs and large enterprises can benefit from the latest treasury management technologies.

What Was the Initial Idea Behind Fennech

Our idea has always been to empower corporates and commoditise the banks. With F³, Fennech Financial Framework, we have built a secure, robust, bank-agnostic, digital, and open platform. This platform addresses the challenges faced by financial leaders and ensures that they have the tools needed to manage their treasury functions efficiently. By fixing the issues with traditional banking systems, we provide a more streamlined and effective solution.

Discover the Transformative Potential of API-Driven Treasury Integration

API-driven treasury integration is not just a modern-day convenience but a strategic catalyst. It enables instantaneous data access, which in turn elevates strategic decision-making. This integration is about making informed decisions swiftly, streamlining operations, and ensuring compliance effortlessly. By leveraging API-driven solutions, you can transform your financial strategy, enhancing both efficiency and effectiveness.

Adopting the new ISO messaging standard is essential for staying ahead in the financial sector. With Fennech's innovative treasury solutions, both SMEs and enterprises can benefit from enhanced data quality, improved interoperability, increased efficiency, and better compliance. Whether you're looking for a full in-house banking system or a simpler treasury management module, Fennech has the right solution to meet your needs.