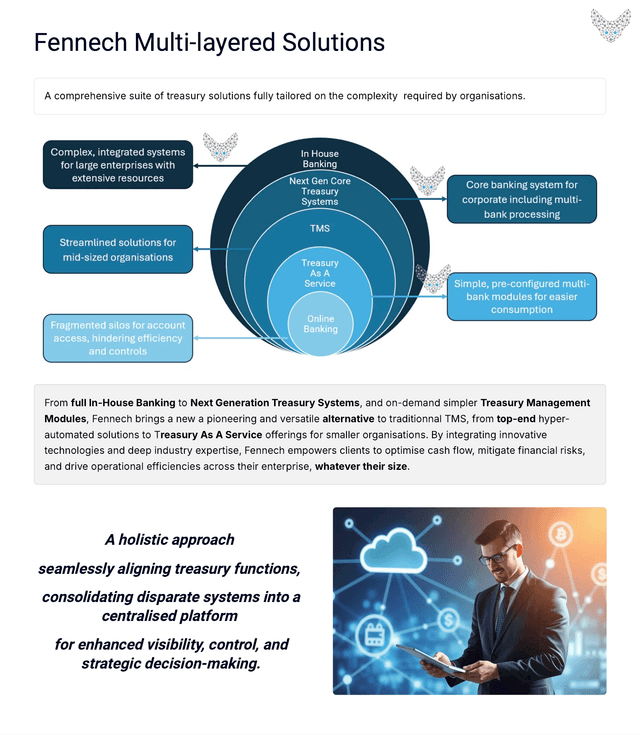

Introducing our innovative in-house virtual banking system, designed specifically for corporations seeking unparalleled control over their financial operations. This cutting-edge solution empowers organizations to manage account maintenance for their subsidiaries seamlessly and interact effortlessly with multiple banking partners.

With our virtual banking platform, companies can optimize their cash positions across various trading and legal entities, ensuring a more efficient allocation of resources. The system automates crucial processes such as credit position controls, cash pooling, and interest distribution, while simplifying loan documentation. This not only streamlines financial management but also enhances overall operational efficiency.

One of the standout features of our virtual banking system is the ability to create unlimited virtual accounts, each governed by tailored business rules for payment allocation. This ensures that every transaction aligns with your organization’s financial strategy, significantly reducing bank charges and minimizing manual intervention. The automation of reconciliation processes further alleviates the burden on finance teams, allowing them to focus on strategic decision-making rather than tedious administrative tasks.

Ideal for both SMEs and enterprise finance leaders, our in-house virtual banking solution fosters a holistic approach to cash management, providing robust tools for tracking and optimizing your. Take control of your finances with Fennech Financial Framework (F³) and unlock the power of your treasury solutions through the innovative In-House Virtual Bank. Designed for today’s dynamic financial landscape, F³ empowers organizations to optimize their financial operations by integrating cutting-edge tools for liquidity management and cash forecasting.

With the F³ In-House Virtual Bank, you can seamlessly create a comprehensive banking solution tailored to your unique needs. This “plug and play” capability allows you to effortlessly connect with multiple banking partners, ensuring that you have the flexibility to manage your finances efficiently and effectively. Say goodbye to the complexities of traditional banking and hello to streamlined operations that reduce costs while enhancing visibility and control.

The In-House Virtual Bank is not just about managing your cash flow; it’s about transforming your treasury and finance teams into strategic partners within your organization. By leveraging advanced analytics and real-time data, your teams will gain unprecedented insights into your financial health, enabling informed decision-making that drives growth.

F³’s In-House Virtual Bank is the key to revolutionizing your financial operations, empowering you to take