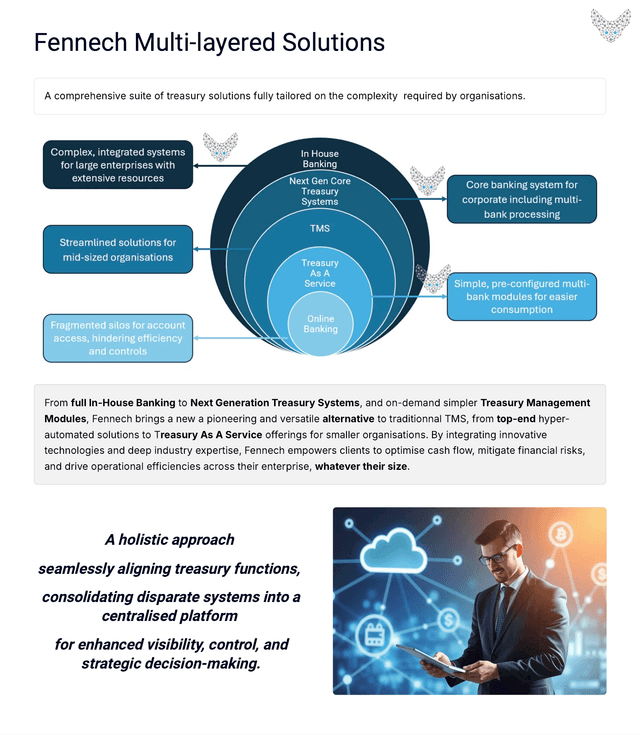

Fennech: Leading the B2B Treasury Automation Revolution

Modern B2B treasury management is no longer about managing finances manually - it’s about adopting smarter, automated solutions to simplify operations, reduce costs, and improve decision-making. Fennech Financial is leading this charge with its F³ platform, designed to revolutionise treasury operations for businesses of all sizes.

Why B2B Treasury Needs Automation

Managing B2B treasury operations comes with inherent challenges:

Manual Workflows: Reconciliation, cash flow forecasting, and payment approvals often require excessive manual intervention. Fragmented Systems: Using disconnected tools creates inefficiencies and complicates data management. Limited Real-Time Insights: Many treasury teams lack instant visibility into cash positions, liquidity, or payment statuses. Regulatory Demands: Adapting to evolving compliance requirements adds strain to already overburdened teams.

How Fennech Transforms B2B Treasury

Fennech’s approach to treasury management focuses on creating an integrated, automated, and future-ready solution. Here’s how the F³ platform excels:

-

Full Workflow Automation F³ automates critical processes like payment workflows, reconciliations, and forecasting, reducing errors and improving operational speed.

-

Centralised Data for Real-Time Insights All financial data is consolidated into a single source, providing treasury teams with real-time dashboards to monitor performance, risks, and opportunities.

-

Seamless System Integration F³ integrates effortlessly with ERP systems, banking platforms, and third-party tools, creating a unified financial ecosystem.

-

Customisation for Every Business Fennech customises its platform to fit the unique needs of B2B operations, allowing businesses to design workflows and solutions that meet specific objectives.

-

Scalable for Growth As businesses expand, F³ adapts seamlessly, ensuring consistent performance and the ability to manage increased volumes or new requirements.

What Makes Fennech Stand Out?

Fennech distinguishes itself from other treasury platforms by focusing on comprehensive service and continuous innovation:

End-to-End Solutions: F³ is an all-in-one platform that addresses every aspect of treasury management, from cash flow to compliance. Proactive Support: Fennech works closely with clients, offering tailored solutions and ongoing optimisation. Future-Proof Technology: Advanced features like AI-driven insights and hyper-automation ensure businesses are ready for tomorrow’s challenges.

Real-World Benefits of Fennech’s Treasury Tools

Efficiency Gains: Automation eliminates time-consuming manual tasks. Enhanced Accuracy: Reduced errors lead to more reliable financial data. Cost Savings: Streamlined processes cut operational expenses. Stronger Compliance: Built-in tools simplify adherence to regulations. Smarter Decisions: Real-time insights and analytics support proactive decision-making.

Your Partner in B2B Treasury Success

Fennech Financial is more than just a treasury solution provider - it’s a partner committed to helping businesses navigate the complexities of B2B finance. With its cutting-edge F³ platform, Fennech is driving innovation in treasury automation and setting the standard for the future.