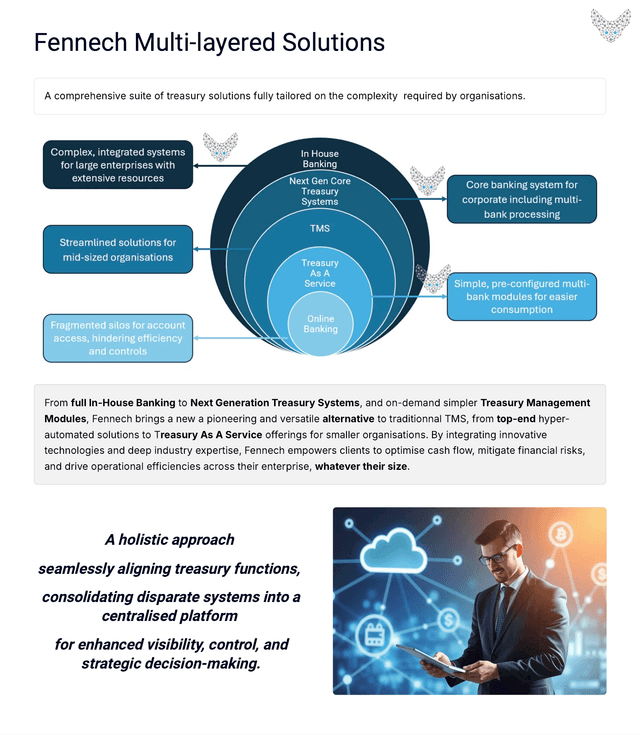

Customised Financial Solutions for Unique Business Needs

As businesses navigate an increasingly complex financial landscape, the demand for tailored solutions has never been greater. Generic, one-size-fits-all platforms often fail to address the nuanced requirements of modern treasury teams, leaving gaps in efficiency and scalability. Fennech Financial sets itself apart by offering fully customised financial solutions designed to meet the specific needs of each business, enabling operational excellence and long-term growth.

The Limitations of Standardised Financial Platforms

Many treasury management platforms focus on providing pre-configured solutions that work well for general use cases. While these platforms may meet baseline needs, they often require businesses to adjust their workflows to fit the software. This leads to inefficiencies, such as:

• Rigid Frameworks: Businesses must conform to the platform’s pre-existing workflows, limiting flexibility. • Overlapping Features: Companies may pay for features they don’t use, leading to wasted resources. • Complex Adjustments: Scaling or adapting these solutions to evolving business needs can require costly customisation or add-ons.

How Fennech Delivers Customised Solutions

Fennech Financial takes a fundamentally different approach, focusing on solutions that adapt to the unique needs of its clients. This client-centric strategy ensures businesses gain maximum value from their financial tools.

-

Modular Platform Design Fennech’s F³ platform offers modular solutions, enabling businesses to implement only the features they need. From cash flow forecasting to in-house virtual banking, Fennech allows companies to create a bespoke suite of tools that fit their operations seamlessly.

-

Flexible Workflows Unlike platforms with rigid workflows, Fennech’s solutions are built around your business processes. This flexibility allows treasury teams to maintain their existing operational structures while benefiting from automation and efficiency improvements.

-

Industry-Specific Expertise Fennech recognises that every industry has unique challenges. Whether it’s insurance, real estate, or multinational corporations, Fennech delivers tailored workflows and tools to meet the specific demands of your sector.

-

Seamless Integration F³ integrates effortlessly with ERP systems, banks, and financial tools, ensuring that businesses can maintain a single source of truth. This eliminates the data silos often associated with less flexible platforms.

-

Scalable and Adaptive Solutions As businesses grow or encounter changing market conditions, Fennech’s solutions evolve alongside them. This adaptability ensures that companies are never constrained by their treasury platform.

The Fennech Advantage: Why Customisation Matters

Customisation is more than just a feature—it’s necessary for businesses seeking to optimise their financial operations. Here’s how Fennech’s approach drives success:

-

Maximised Efficiency Tailored solutions eliminate inefficiencies by aligning with your exact workflows. This reduces manual intervention and frees up resources for strategic initiatives.

-

Enhanced Control and Visibility With custom dashboards, reporting structures, and workflows, treasury teams gain complete control over their financial operations, ensuring accurate data and actionable insights.

-

Cost-Effective Solutions Fennech’s modular approach ensures businesses only pay for the tools they need, avoiding the unnecessary costs associated with bundled, standardised platforms.

-

Future-Proof Operations Custom solutions grow and adapt with your business, ensuring you remain competitive in a rapidly evolving market.

Differences That Set Fennech Apart

Standard platforms often excel in offering comprehensive out-of-the-box solutions. However, they may fall short in addressing the specific, evolving needs of individual businesses. Fennech bridges this gap by providing:

• A Personalised Approach: Working closely with clients to understand and address their unique challenges. • Rapid Implementation: Ensuring minimal disruption during deployment with solutions tailored to existing infrastructure. • Continuous Optimisation: Offering ongoing support to refine workflows and adapt to changing business conditions.

Unlock Your Business Potential with Fennech

Fennech’s customised financial solutions empower businesses to streamline operations, optimise resources, and achieve their strategic goals. By delivering tools designed specifically for your needs, Fennech enables you to focus on what truly matters: driving growth and innovation.