How Automation Eliminates Manual Financial Processes

In today’s financial environment, manual processes are no longer viable for businesses aiming to maintain efficiency and accuracy. Automation has become essential for transforming financial operations, reducing human error, and freeing up valuable resources. While many platforms offer basic automation capabilities, Fennech Financial sets itself apart by delivering advanced automation that redefines financial workflows and empowers treasury teams to focus on strategic initiatives.

The Limitations of Basic Automation

Standard automation platforms often address specific tasks but fall short of streamlining end-to-end processes. Common issues include:

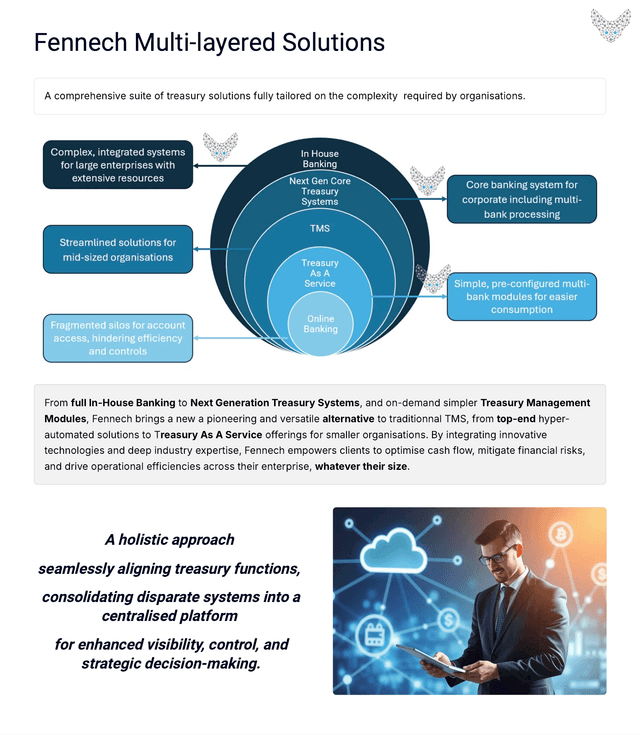

• Limited Scope: Automating isolated tasks without connecting workflows leaves inefficiencies in the overall process. • Manual Intervention: Basic platforms often require human oversight at multiple stages, increasing the risk of delays and errors. • Scaling Challenges: Adapting simple automation tools can become resource-intensive and costly as businesses grow. Fennech’s advanced automation solutions eliminate these challenges, delivering a holistic approach to financial transformation.

Fennech’s Approach to Advanced Automation

Fennech Financial leverages hyper-automation—a combination of AI, ML, and RPA—to create a fully integrated system that optimises financial operations.

- End-to-End Workflow Automation Fennech automates entire processes, from payment initiation to reconciliation and reporting. This reduces manual intervention, allowing treasury teams to focus on high-value tasks.

- Intelligent Decision-Making AI-powered analytics enable F³ to make data-driven decisions in real-time, such as detecting anomalies in transactions or optimising cash flow management strategies.

- Seamless Integration F³ integrates with ERP systems, banks, and other financial tools, ensuring that automation flows smoothly across all platforms without requiring additional workarounds.

- Dynamic Adaptability Unlike rigid systems, Fennech’s automation adapts to changes in business operations or regulatory requirements, providing continuous optimisation.

- Proactive Error Detection F³’s automation identifies discrepancies and potential errors early, minimising risks and ensuring accuracy throughout the financial process.

The Benefits of Advanced Automation

Businesses adopting Fennech’s advanced automation experience transformative improvements, including:

- Increased Efficiency Automation reduces the time spent on repetitive tasks, allowing teams to focus on strategic objectives.

- Enhanced Accuracy By eliminating manual processes, F³ minimises errors, ensuring precise financial data and operations.

- Cost Savings Streamlined workflows and reduced manual intervention lower operational costs and improve resource allocation.

- Better Risk Management Proactive monitoring and real-time analytics help identify and mitigate potential risks before they escalate.

- Scalability F³’s modular design grows with your business, providing consistent support as operations expand.

Why Choose Fennech for Advanced Automation?

Fennech Financial delivers advanced automation solutions that are tailored to meet the needs of modern businesses. With F³, companies gain:

• A Unified Platform: Manage all financial operations within a single, integrated system. • Real-Time Intelligence: Access actionable insights to make faster, better decisions. • Continuous Optimisation: Automation that evolves with your business and the market. • Proactive Support: Dedicated guidance to maximise the value of automation tools.

Transform Your Financial Operations Today

Manual processes slow businesses down, but Fennech’s advanced automation eliminates inefficiencies and positions companies for success. By adopting F³, treasury teams can achieve unparalleled efficiency, accuracy, and control.